|

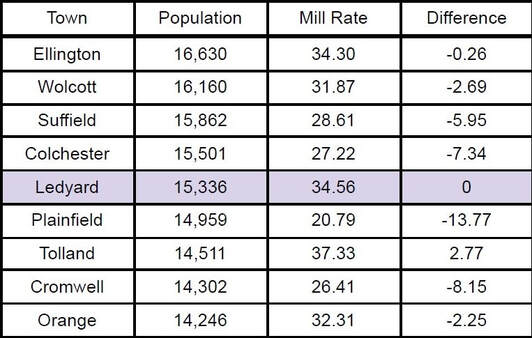

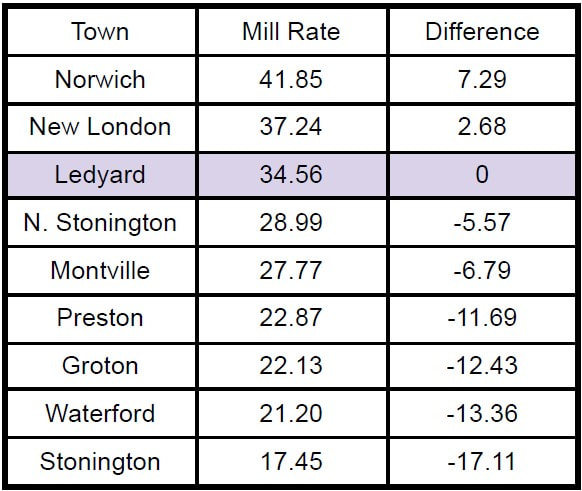

Ledyard’s current Mill Rate is 34.56. How does this rate compare to: 1. The rest of the state? Ledyard has the 42nd highest Mill Rate out of Connecticut's 169 towns. This ranks at the 25th percentile - so among the top quarter of Mill Rates in CT. 2. Towns that are about the same size as ours throughout CT? 3. Towns around us?

But Mill Rate alone does not tell the whole story, unless you include a town’s Grand List and Budget. Grand list is the sum of all of the property assessments, and the Budget is the amount of money the town has to collect. To lower a Mill Rate, you either need a bigger Grand List or a smaller Budget. See below for a primer on Mill Rates and Municipal Taxation. Mill Rates and Municipal Taxation: A Primer1. Article Ten of CT's State Constitution deals with Home Rule, and establishes that the Assembly

shall “delegate such legislative authority as from time to time it deems appropriate to towns, cities and boroughs relative to the powers, organization, and form of government”. This includes telling the towns how they can tax to generate revenue. Currently, Property Taxes are the only form of tax town governments are allowed to levy to generate revenue for themselves. This tax comes in 2 forms: Real Property (like your house) and Motor Vehicles. 2. Connecticut General Statutes, Title 12, Taxation, covers the process by which property assessment and taxation occurs. CT’s Fiscal Year runs from 7/1/2023 to 6/30/2024. a. Chapter 203, §12-55 requires the Assessor to “publish the grand list for their respective towns” by 31 January each year following the assessment process. §12-62a tells assessors to use 70% of the property value as the assessed value. b. Chapter 204, §12-122 requires that, “Upon completion of the work of the board of assessment appeals and of the final assessment list, the town shall levy a tax on such list…” Ledyard’s Town Council fixed the Mill Rate on 6/14 of this year, after the budget passed. c. “Municipal Authority to Tax Property," a report by the Office of Legislative Research is a great summary of how this system got to be the way it is and how it works (5 pages). d. The maximum Mill Rate for Motor Vehicles is 32.46. It is set by statute. This OLR report is a great quick history on the Motor Vehicle Tax. 4. A Mill is $1 for every $1,000 assessed. Think ‘milli’, as in ‘thousandth’ in the metric system. For example, if my house was appraised at $250,000, the assessment would be for 70% of that, or $175,000. With a Mill Rate of 34.56 (or 34.56 dollars per 1,000 dollars), the property tax on my house would be: ($175,000) x (34.56/1000) = $6048. And if my car is assessed at $10,000, I will get a tax bill of (10,000) x (32.46/1000) = $324.60. Sources: Estimated Populations in Connecticut as of July 1, 2021. State of Connecticut, Department of Public Health, Health Statistics and Surveillance, Surveillance Analysis and Reporting Unit. This is a town by-town population count, based off the 2020 Census. Mill Rates. State of Connecticut, Office of Policy Management. This is a town-by-town listing of Mill Rates. This page also has the definition of Mill Rate. |

RSS Feed

RSS Feed